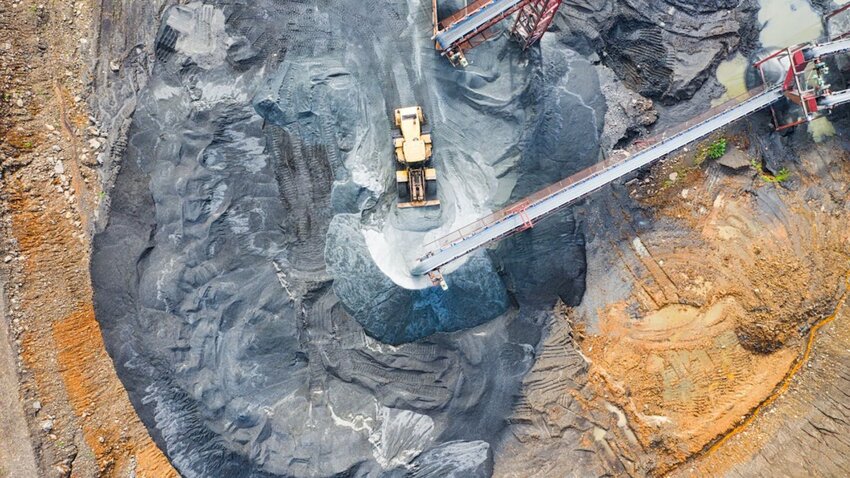

The race for Critical Raw Materials (CRMs) is undoubtedly one of the most sensitive topics in contemporary geopolitics. Lithium, copper, nickel, cobalt, and rare earth elements may be invisible to the wider public, yet they are essential for the technologies driving the ecological and digital transition, without even considering the additional boost from weapons and the space economy. Without these resources, there would be no electric cars, solar panels, wind turbines, semiconductors, or next-generation batteries. This is why securing their supply has become a source of mounting tension among the world’s major powers.

The fragility of a global supply chain

When it comes to critical raw materials, the rules resemble a game of chess: those who have the centre, namely those who control the main deposits and refining stages, dictate the moves and hold the advantage. As highlighted in the Global Critical Minerals Outlook 2025 by the International Energy Agency (IEA), only three countries currently account for 86% of global refining capacity, with more than three-quarters of that under the control of the People’s Republic of China.

This concentration is not just about refining, but also the extraction of raw materials. Indonesia is the largest producer of nickel, the Democratic Republic of Congo dominates cobalt production, and Australia leads in lithium. Yet, China plays a decisive role in the higher-value stages: it refines over 90% of rare earths and 75% of cobalt, and is the world leader in both synthetic and natural graphite production. Moreover, advanced materials such as gallium, germanium, tantalum, and zirconium are critical for strategic sectors including artificial intelligence, aerospace, defence, and telecommunications, making reliance on a small number of suppliers a serious vulnerability.

The surge in demand is piling on further pressure. Despite the emergence of new technologies such as sodium batteries, global lithium consumption rose by 30% in 2024, while extreme weather events have compromised 7% of global copper production, which, although not currently classified as critical by the EU, is considered strategic for electrical grids, motors, and electronic components. According to IEA projections, a shortfall of up to 30% could emerge by 2035, driven by the declining quality of deposits, lengthy approval processes, and inertia in developing new projects. Price fluctuations, which are more pronounced than for oil and gas, have made the market unstable, discouraging new investment and slowing down the diversification of supplies.

- You may also be interested in: Tapojarvi Italia: the Finnish innovation turning steel slag into green gold

The European response

Faced with this scenario, the European Union has decided to batten down the hatches. With the Critical Raw Materials Act (CRMA), which came into force in May 2024, Brussels aims to strengthen its industrial autonomy. The target? By 2030, 10% of demand should be met through domestic extraction, 40% through refining, and 25% through recycling. In this context, in March 2025, the Commission approved 47 strategic projects across 13 member states. Among the most significant is POLVOLT in Poland, a large-scale plant for recycling spent batteries. It will enable the recovery of lithium, nickel, manganese, cobalt, and copper, providing each year enough material to manufacture up to two million electric vehicles.

- You may also be interested in: Critical raw materials: EU backs 60 strategic projects

The Italian front

Italy, traditionally lacking major mines, is also back in the game. Through the National Mineral Exploration Programme (Programma nazionale di esplorazione mineraria - PNE), 14 projects have been launched in 11 regions, backed by 3.5 million euros in funding. The aim is to update knowledge of the underground, identify potential deposits of critical materials, and map abandoned mining waste sites through the URBES project, which seeks to create new opportunities for recovery and remediation. All data collected will be brought together in the GeMMA portal, the new national mining database, designed to make geological and mineral information accessible and interoperable for both public and industrial purposes.

Circular economy

Beyond extraction, the real challenge lies in embedding the principles of the circular economy: recover, recycle, reuse. Rare elements carry a significant environmental footprint at every stage of extraction and transport. Reducing this footprint through circular processes could turn a geopolitical vulnerability into an opportunity for innovation.

This will be the central theme of the conference “Italy responds to CRM Act: re-starting from strategic projects”, scheduled during the next edition of Ecomondo (Rimini, 4–7 November 2025), with a dedicated session on 6 November from 14:00 to 17:00. The initiative, organized by the Ecomondo Scientific and Technical Committee, Politecnico di Torino, and the European Commission, brings together key players including the government, the geological survey, research bodies and industry to discuss key elements of an Italian response to the CRM Act. The event promises to look beyond national borders, focusing on dialogue and synergies at European and international levels.

Article written by Giorgio Kaldor

This blog is a joint project by Ecomondo and Renewable Matter

Credits:

PUBLICATION

12/09/2025